Ultra-Millionaire (2 Cent) Tax

“This is America—we’re happy to invest in opportunities for everyone. But we’re saying that if you make it really, really, really big, bigger than 50 million dollars, then pitch in two cents so everyone else can have a chance.” – Elizabeth Warren

Download the Ultra-Millionaire (2 Cent) Tax one-pager

WHAT THIS PLAN IS ABOUT

We need to fundamentally transform our tax code so that we tax the wealth of the ultra-rich, not just their income. That’s what the Ultra-Millionaire (or two cent) tax is about in order to create a better economy and a better democracy for all of us.

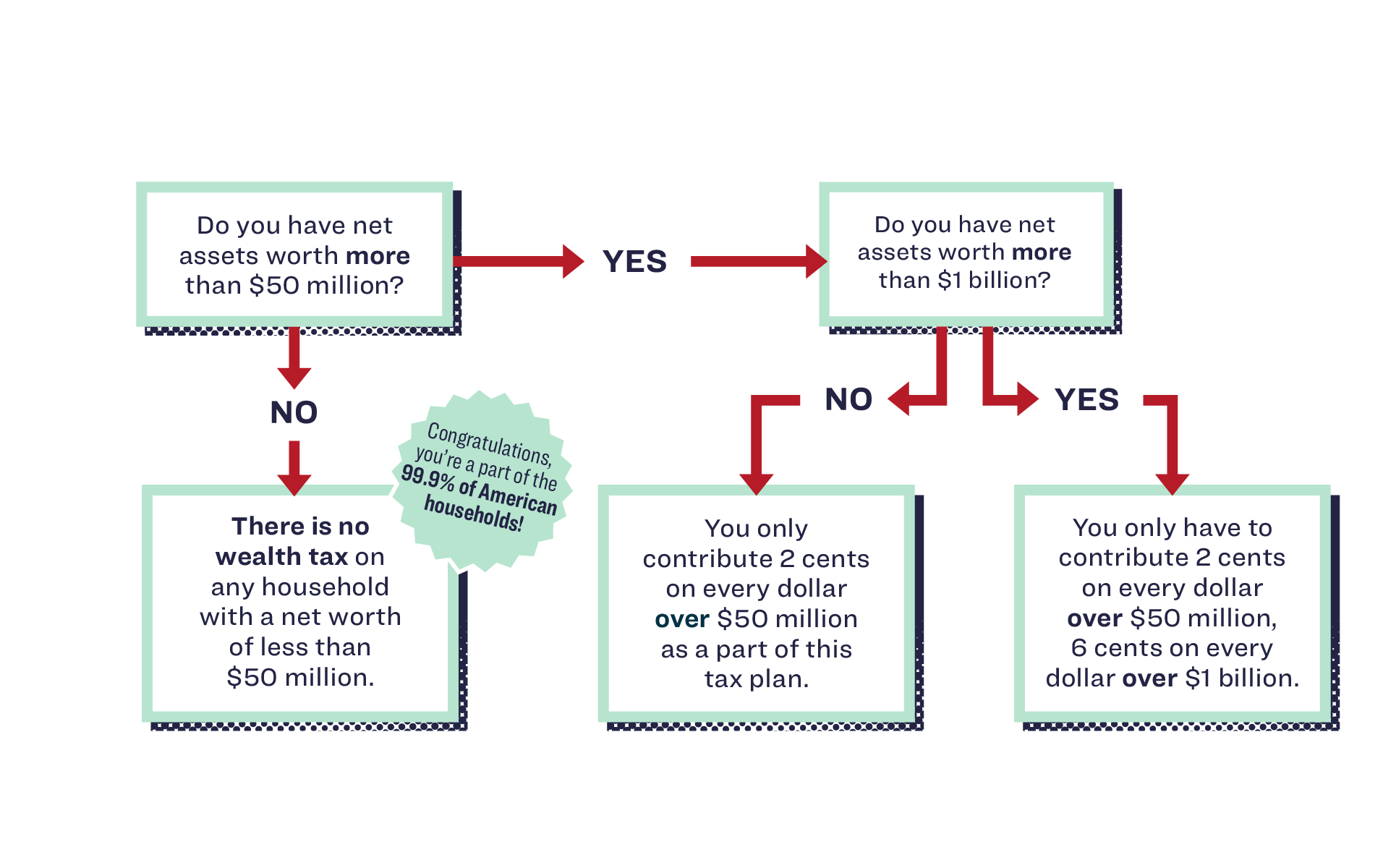

Here’s how it works: A family with a net worth of more than $50 million – roughly the wealthiest 75,000 households – would pay a 2% (or 2 cents) tax on every dollar of their net worth above $50 million and a 6% (or 6 cents) tax for every dollar above $1 billion.

That’s it – simple.

Wealth in this country is so lopsided that this small new tax on the tiny sliver of ultra-rich families will bring in $3.75 trillion over the next ten years. Think about how that money could be used. We can invest it in:

- universal child care and Pre-K, including raising wages for child care workers and preschool teachers,

- tuition-free technical school and two- and four-year public college,

- canceling student loan debt for 95% of people who have it, and

- financing Medicare for All.

This is an investment in the future of our society.

WHY IT’S NEEDED

The rich and powerful run Washington. And what’s more: After making a killing from the economy they’ve rigged, they don’t pay taxes on that accumulated wealth.

For decades, the wealthy and the well-connected have put American government to work for their own narrow interests. As a result, a small group of families has taken a massive amount of the wealth American workers have produced, while America’s middle class has been hollowed out.

The result is an extreme concentration of wealth not seen in any other leading economy. And this disparity also has an impact on the racial wealth gap: The 400 richest Americans currently own more wealth than all Black households and a quarter of Latino households combined.

WHO WOULD BE AFFECTED BY THE TAX

Roughly 75,000 households or the top 0.1% would be affected. Here’s what that looks like:

WILL I BE AFFECTED?

Want more? Read Elizabeth’s full plan here.